FSA

Flexible Spending Accounts

Healthcare FSA

Our standard Healthcare FSA allows employees to set aside pre-tax dollars to cover qualified out-of-pocket medical expenses such as copays, prescriptions, medical equipment, and more. With easy claims processing, user-friendly online portals, and mobile app access, managing healthcare dollars has never been easier.

Limited Purpose FSA

For employees enrolled in a Health Savings Account (HSA), we offer a Limited Purpose FSA designed specifically for dental and vision expenses. This account helps participants maximize their tax savings while maintaining HSA eligibility.

Dependent Care FSA

Our Dependent Care FSA helps working parents manage the costs of childcare or eldercare by allowing them to use pre-tax funds for eligible dependent care services. This includes daycare, preschool, before- and after-school programs, and adult day care services.

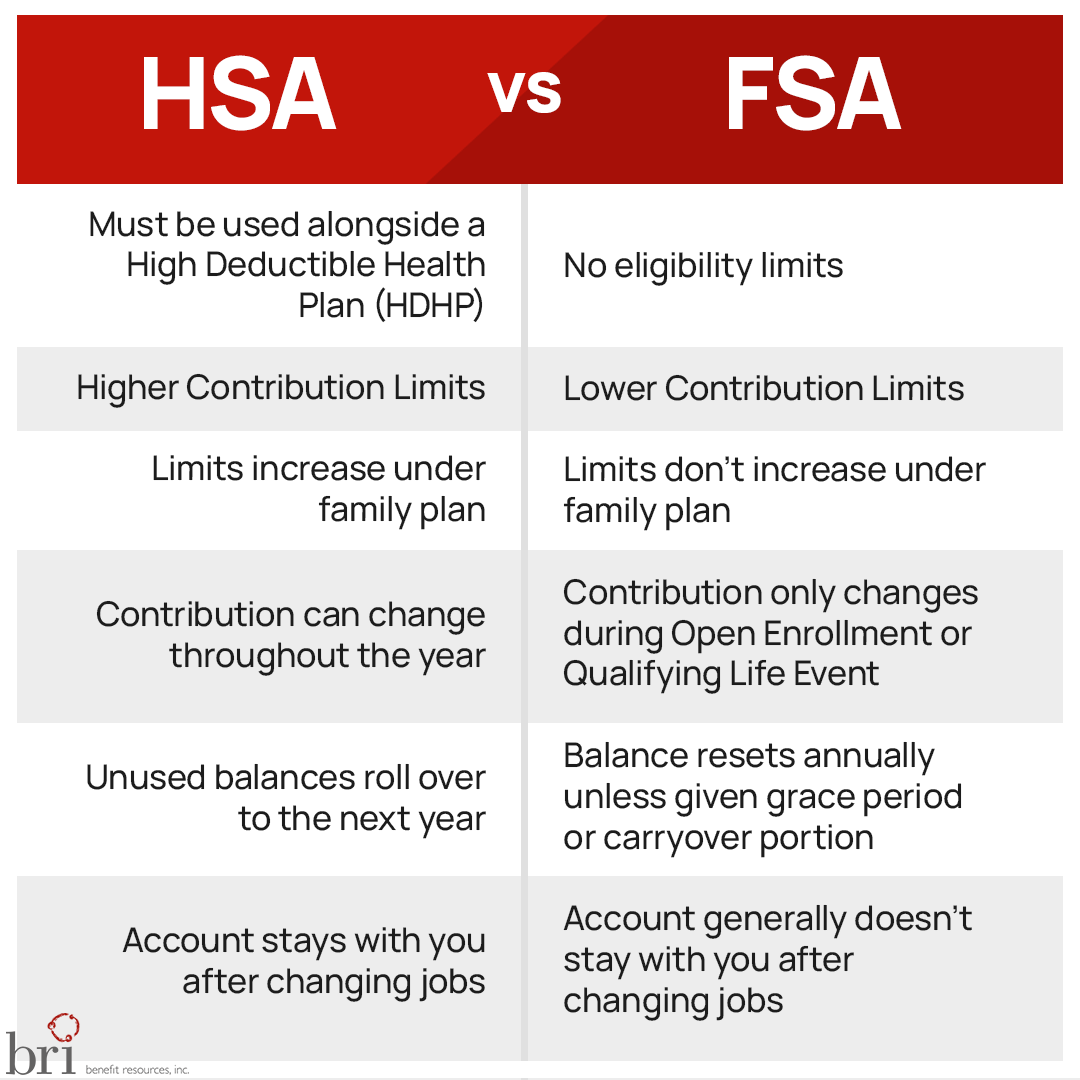

The Difference Between an HSA & FSA

Both HSAs and FSAs help employees save money on eligible healthcare expenses by using pre-tax dollars, but they differ in key ways. They cannot be used together, unless your FSA is a Limited Purpose FSA.

What Sets Us Apart

Technology and superior customer service differentiates us from our competition. We designed our system to enable the rapid transfer of information and funds by eliminating much of the paperwork. Administration has been made easy with the BRI system because we have designed our program around a common theme: reduce the burden on the Human Resources Professional.